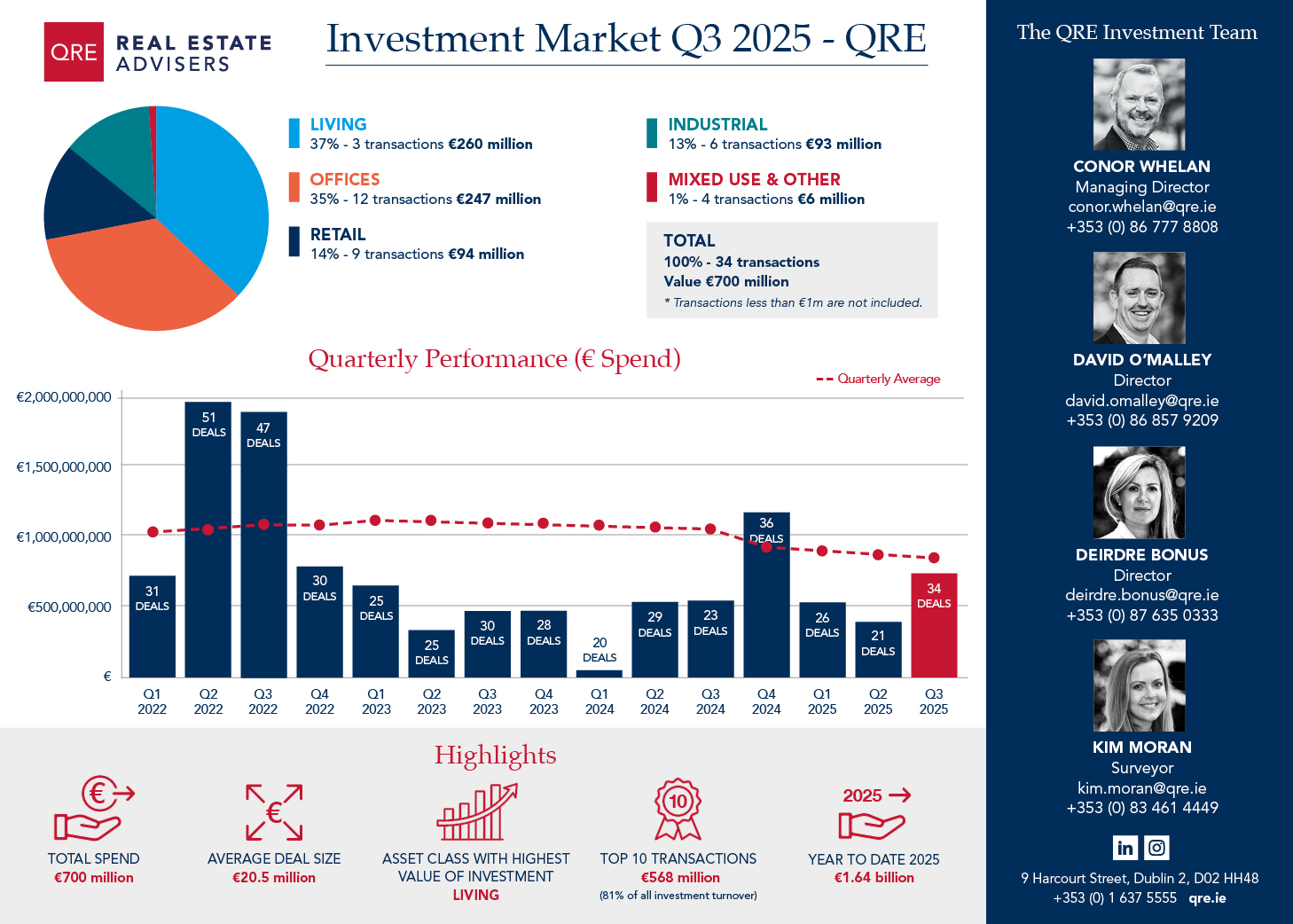

Total investment turnover in Q3 2025 reached approximately €700 million across 34 transactions, reflecting an average deal size of just over €20 million. The two largest transactions were Spencer Place, Dublin 1 (€177m) and Birchwood Court, Dublin 9 (€79m) - both within the living sector. Total spend in this sector amounted to €260m, or 37% of the market. Office investment amounted to €247m or 35% of spend. This brings total investment volume to approximately €1.6bn for the year to date.

Ireland remains an attractive destination for investment. In the office sector, prime city centre locations continue to perform best, while the suburban market has been notably impacted by softer demand. Student accommodation and residential investments have seen an uptick in activity, driven by undersupply and strong occupier demand. There is pent-up demand for retail investment, though, similar to the industrial sector, the availability of suitable product remains limited.

Overall, investor sentiment is perhaps slightly cautious in the office sector particularly, tempered by ongoing geopolitical and economic uncertainty, but the medium-term outlook is broadly positive for other sectors as confidence gradually rebuilds.